As Canada grapples with the potential for tariffs to disrupt its economy, issues such as inflation, strained supply chains and long-term economic instability remain.

A series of tariff escalations between the U.S., Canada and Mexico has intensified economic uncertainty. On Feb. 1, 2025, President Donald Trump signed executive orders imposing 25 per cent tariffs on Canadian and Mexican goods and 10 per cent on Chinese goods.

These tariffs started on March 4, 2025, after a 30-day delay. Auto imports and trade under the Canada-United States-Mexico Agreement (CUSMA) were exempt until April 2, 2025.

In response, Ontario imposed a 25 per cent export tax on electricity sold to certain U.S. states on March 10, 2025. The following day, Trump threatened to raise steel and aluminium tariffs on Canadian exports to 50 per cent.

Brant Abbott, a professor of macroeconomics at Queen’s University, explained tariffs drive up consumer prices, affecting both domestic and imported goods.

“When Canada puts a tariff on imports, consumer prices directly increase,” he said. “We will likely also see additional price increases for imports as U.S. producers experience higher input costs.”

However, Canadian-produced goods could become more competitive, offering some relief. “Most economists expect this to be a one-time price increase, rather than the beginning of sustained high inflation,” Abbott noted.

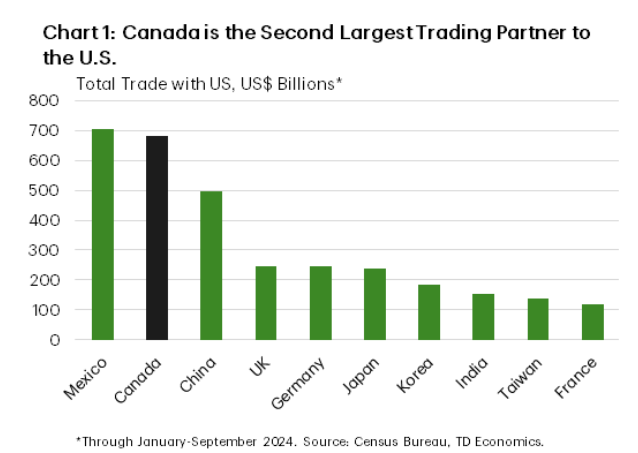

According to TD Economics, in the first three quarters of 2024, approximately $800 billion Canadian in goods and services crossed the Canada-U.S. border.

Total trade boosted to $910 billion Canadian during the same period.

Şebnem Kalemli-Özcan, Schreiber Family professor of economics and director of the Global Linkages Lab at Brown University, emphasized tariffs cause “inflationary pressures in both countries since it is a cost-push shock,” but warned their effects differ.

“It is short-term in both countries, but price levels can be permanently higher in the tariff-putting country, that is, the U.S.,” she said.

Tariffs introduce significant disruption to supply chains, labour markets and consumer behaviour in both the U.S. and Canada.

“Bad impact in both, worse for Canada,” Kalemli-Özcan warned.

Abbott echoed the sentiment: “uncertainty tends to hurt investment and so Canadian productivity will likely suffer for many years even if the trade war resolves quickly.”

Both experts agree Canada is particularly vulnerable due to its dependence on international trade.

“Obviously, a closed economy would be immune to external tariffs,” Abbott said. “However, the degree of specialization that trade allows us as a country is paramount in the prosperity we enjoy.”

Kalemli-Özcan said that in response to tariffs, both the U.S. Federal Reserve and the Bank of Canada will likely adjust interest rates.

“If tariffs are inflationary, then both banks will increase the rates,” Kalemli-Özcan added.

Abbott explained monetary policy has limitations in a trade war.

“Central banks don’t have much leverage during a trade war,” he said. “Monetary policy can’t respond to both lower growth and higher inflation at the same time.”

However, the Bank of Canada may consider lowering rates to stimulate demand.

“If tariffs are imposed, demand is expected to fall more quickly than supply. This would hurt economic growth,” he noted.

The Bank of Canada cut the interest rate to 2.75 per cent on March 12, a day after Trump threatened to raise tariffs on steel and aluminum tariffs.

Still, if tariffs cause a rise in inflation expectations, higher interest rates may be necessary to prevent prolonged inflation.

“Whether the one-time price increases associated with tariff introduction cause inflation expectations to rise will be a key factor in what path policy takes and how the economy evolves,” Abbott noted.

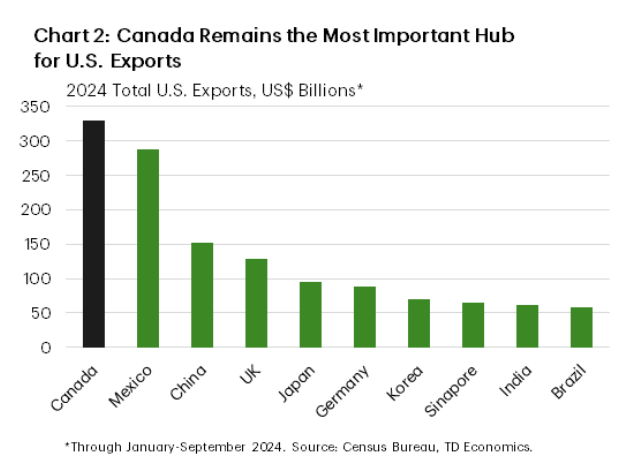

With the U.S. becoming increasingly protectionist, experts say Canada must look elsewhere for trade partnerships.

“The U.S. does not want to diversify anything as the U.S. does not want to trade with others,” Kalemli-Özcan said. Instead, she suggested Canada can get into an agreement with Europe and China.

Abbott, however, believes Canada-U.S. trade relations will stabilize once the trade war ends. “History tells us to expect Canada-U.S. trade relations will resume normally after the trade war ends,” he said.

Beyond inflation, tariffs can have severe unintended consequences for financial markets, supply chains and economic stability. Kalemli-Özcan described the potential fallout as horrible and warned of excessive market volatility, blocked supply chains and economic instability.

Certain Canadian industries are at greater risk, according to Abbott.

“Manufacturing and resource extraction will likely be hit harder as their outputs are directly affected,” Abbott said. “Ultimately, though, almost any business will be affected in some way as input costs rise.”

Both Canada and the U.S. must implement stimulus and subsidies to protect businesses and consumers, Kalemli-Özcan argued. However, Abbott warned against excessive government intervention.

“Government needs to be prudent with assistance programs so as not to overstimulate demand,” he said.

As the world becomes more interconnected, many economists question whether tariffs remain a viable economic tool.

“Tariff is not a strategic economic tool, it is a coercion policy which is only used by aggressive and oppressive regimes for coercion, not for strategy,” said Kalemli-Özcan.

She added that while the U.S. may continue using tariffs, the only other country she would expect this type of behaviour from is Russia and China, not Canada.